The year 1974 was a pain in the butt in a lot of ways, especially trying to land that first full-time, serious job, or launch that career. There was a recession on back in that year that was somewhat similar in its effects on that year's graduates as the 2008 Recession still has on graduates today. Some of that summer was very memorable, with the exception of job hunting, especially the friends with whom I shared that last summer after graduation. One of the last hit songs before I got released from college (with a new suit and bus fare) was the group Redbone's Come and Get Your Love, which came out about May 1974. I remembered this song when one of the satellite music channels that are broadcast on this week's Holiday Inn Express television (Room 408) was a 1970s channel, and it played Come and Get Your Love along with some facts about that group I never knew even after owning the vinyl 45 RPM single since 1974. Redbone was comprised entirely of American Indians, or Native Americans. I use both titles as some individuals from that segment of the United States actually prefer one or the other, so this will cover both preferences. I will have to do further research to find out from which Nation, or Nations, of Indians all the band members originated, as that fact is even more important to the Native Americans as someone is Lakota, Seneca, Delaware, etc. and then "American Indian" or "Native American." An individual's heritage, family history, and traditions spring from the Nation of origin. Come and Get Your Love was one of the most popular songs from that period of 1974 and one I liked enough to purchase the single, but never found out anything about the artists as this was the biggest hit single Redbone made. I will have to find a copy of the CD with their most successful recordings, now. Redbone often wore traditional dress when performing live.

Some other songs I remember most from this period include Rock the Boat by the Hughes Corporation; Rikki Don't Lose that Number by Steely Dan; Haven't Got Time for the Pain by Carly Simon; Midnight at the Oasis by Maria Maldaur; Dancing Machine by the Jackson 5; Don't You Worry 'bout a Thing by Stevie Wonder; and Let Me Be There by Olivia Newton-John (who would be very big by 1978's Grease and into the 1980s). Back when both AM and FM radio played the top 40 or 50 songs continually every day, it got easy to bookmark the songs with their years, just like we see with 1974. You think of a year, and one or more songs start playing in your head, or you hear a song and it brings back a year. With all the changes in the music business since the Internet took off, that mental filing system abruptly stopped about 1996.

Senator Lindsay Graham is suggesting the need for some kind of US-funded rebuilding program for Libya. Now, the only way a country running a deficit of over one trillion dollars can finance another country's rebuilding is by borrowing the money. In this case, as in so many others, we will have to somehow get China to lend us the money since China now has most of our manufacturing plants and, therefore, a great share of the revenue the federal government is not getting through today's tax system. Being that it was mostly our bombs that blew up Libya, since the Europeans rapidly ran out of their own bombs and Uncle Sam will always be there to provide for them, I suppose there is some justice to our helping to rebuild yet another country. I really don't know what else the American public could have expected since we always pay to rebuild countries our government blows up. They could--maybe--try to talk our leaders out of blowing up any more countries until they get the economic mess solved, but too many people have tailgate parties at football games to organize and reality shows to watch on TV, I guess.

Yesterday was my last morning on a downtown Philadelphia assignment. The final meeting was late yesterday morning, so on Friday I could "just" make the 340-mile trip home. While showering this morning, I heard what I swore was a wild bird chirping in the room next door. Thinking the shower fan might be squeaking, I turned it off for a few seconds and listened again. It was the sound of a bird chirping, and sounded like it was right next door, probably in the neighboring bathroom. When I was on the way to the office to check out, I told one of the cleaning people what I heard. She told me that she would tell maintenance to check it out. If there was a bird in there, they would help it get out through an open door. The bird sounded like a small sparrow or chickadee, probably a female as one was once trapped in the atrium of the Alexandria, Virginia Embassy Suites a few years ago. When the female sparrow could not get out after one full day, I rigged up some feeding and watering stations and strung them up on different artificial trees in the atrium, using crushed crackers and bottled water in the bottoms of paper cups. The feeding stations were hung by heavy black thread from my briefcase sewing kit. The sparrow used the feeding and watering stations until she finally found her way out during my stay at the hotel.

The now infamous "Underwear Bomber" was all ready to fight out in court his hatred for America and the policies of its government while acting as his own legal counsel. Actually, the court appointed a lawyer to serve as the Underwear Bomber's advisor just to make sure he couldn't claim reversible error and get an appeal. After all, it is hard to think of anyone who would put a bomb in his underpants to be rational enough to defend himself in court in a slam-dunk case prosecution case. Abdulmutallab was willing to be a martyr for his cause, blowing himself up inside an airliner at 30,000 feet. No one in authority has yet let us know just how Abdulmutallab was supposed to claim credit for his one-man terror strike after he blew himself to bits with the plane full of people. Now, suddenly, the Underwear Bomber decides to plea bargain with the US Attorney to get a lighter sentence. When I saw this in the paper on the SEPTA train this morning, I turned to another commuter to declare with disgust, "Look at this chicken(bleep) Underwear Bomber. He wanted to be a martyr, but now he takes a plea bargain from the prosecutor. What a wuss."

The bomber was only going to call one witness in his defense, the most ardent opponent of the government's "official story" about how the Underwear Bomber got on that plane in the first place, Detroit Attorney Kurt Haskell. Abdulmutallab got on that plane without a passport and without going through security. Haskell would have testified that a well-dressed man argued the bomber's case for getting on the plane with the clerks at the airport in Amsterdam, finally getting the bomber on the plane at the last second. Then Abdulmutallab's underwear started smoking after take-off for Detroit, and we all know the rest of the story that includes everyone wanting to fly getting either irradiated or groped in airport security since "everyone" is automatically an "Underwear Bomber" until they prove they are not an "Underwear Bomber."

Another witness Abdulmutallab might have wanted to call was Patrick Kennedy, the head of the State Department's visa office. Kennedy had to appear before a Congressional Committee to help the confused Congress members figure out just how the Underwear Bomber got on the plane so easily when elderly women in wheel chairs get challenged by security. Kennedy dropped a bomb of his own by stating that an American "intelligence agency" wanted Abdulmutallab to get into the United States so that they could "follow him" to see if he led them to other terrorists. Kennedy refused to identify which "intelligence agency" that was in open testimony. Too bad the same "intelligence agency" didn't think of having their erstwhile Judas goat frisked at least half as thoroughly as Brownie Scouts get frisked at airports today. We all know how dangerous Brownies are. Those Samoa cookies the Brownies sell could cause obesity. I think it was to avoid having Kennedy's story come out in court that encouraged the prosecutor to cut a deal with the Underwear Bomber. After all, most Americans didn't watch C-Span when Patrick Kennedy turned tattletale.

The reason why most Americans know nothing about the testimony of Undersecretary of State Patrick Kennedy about the "Intelligence Agency" that insisted the State Department let the Underwear Bomber on the plane is thanks to a "mainstream media" that have chosen to not inform the American people about Kennedy's testimony to Congress. This reminds me of arguments I have frequently heard from those who claim that cover-ups by government bureaucracies and politicans can't work because reporters are always looking to be first with such a sensational story and getting a "scoop." Apparently those people were wrong and the entire "mainstream" media will refuse to grab a "scoop" when the "scoop" contains information like what was provided by Patrick Kennedy. A few people in the right places can keep something out of the limelight. We just don't know exactly who can silence a supposedly aggressive media, but, then again, Charlie Sheen's and Lindsay Lohan's woes are more important, I guess, than who was ultimately responsible for giving the Underwear Bomber the opportunity to set off his knicker bomb.

The Underwear Bomber might think he escaped a worse fate, but the attorney who got him the deal won't be joining his client in the slammer. Federal prisons are not the safest places in the world. Meanwhile, the vast majority of the American people still don't know just how Abdulmutallab got on that plane after the Underwear Bomber's own father warned our government that his son was running with terrorists. One thing we do know is, no matter how draconian the airport security, if an "Intelligence Agency" wants to get one of these cats on a plane, he'll get on the plane. Keep that in mind while you are taking your shoes off in the security line.

Kind of makes you long for the days when Pan Am flew with stewardesses like Christina Ricci.

Back in 1988, just prior to receiving permission from my employer that I could transfer to the western half of Pennsylvania, popular music went through a period of injecting hopeful and optimistic lyrics to some best-selling tapes and CDs. In 1988, CDs were still relatively new, while cassette tapes were the prevalent medium for selling "albums." Two of my favorite examples of what Mary Stuart Masterson once described as "Radical Optimism" during a commencement speech at Elmira (New York) College in 2010 are Steve Winwood's Roll With It and Gloria Estefan's Get on Your Feet. I already owned a copy of Ms. Estefan's Greatest Hits CD that included Get on You Feet. Gloria Estefan and her Miami Sound Machine were one of my favorite musical groups from the 1980s and early 1990s. While I liked some of Steve Winwood's work in those days, I was usually content to catch his stuff on the FM radio during audit jobs as the "clients" usually had an FM station up and playing Top 40 songs all day. Anyway, both the songs I've mentioned send the listener's the clear message that they should not give up on life when they get dealt a bad hand or two.

Is there anything more ironic than a United States Treasury Secretary giving other governments advice about how to get their debts under control? If anyone can think of anything more ironic than this, please let me know because nothing comes immediately to my mind. Secretary Geithner appeared at a meeting of Euro Zone finance ministers to offer his advice about fixing Europe's sovereign debt and banking crisis. His appearance didn't go over well with Austria's Finance Minister, Maria Fekter saying, "I found it peculiar that, even though the Americans have significantly worse fundamental data than the euro zone, that they tell us what we should do."

Aw, come on Ms. Fekter, Geithner was involved when all of the mess started, so who is best qualified to fix it? When it comes to "managing debt" we are the world's greatest experts since we owe just about the entirety of our Gross Domestic Product. You Euro-types are a bunch of pikers compared to our leaders. We are even thinking about changing our national motto to "I would gladly pay you Tuesday for a hamburger today," as Popeye's freeloading cartoon buddy, Wimpy, liked to say.

The Europeans don't have to worry much, since our Super Bankers, the Bubble Boys of Wall Street, have a stake in some of their debts over there, we will find a way to help with the bail-out since we all know the world as we know it will come to an end if the Mega Banks lose anything. That's right, now we are going to bail-out "Europe" since some of those billions are owed to the Mega Banks. Where are we going to get the money? Generations yet unborn will get stuck with the bill again.

The British journal, Guardian reports that researchers have discovered a particle that travels at speeds faster than light speed. The scientists working at the Gran Sasso facility, located under a mountain in central Italy, claim to have discovered this particle that, if proven correct, will overturn a key part of Einstein's Theory of Special Relativity. Breaking the speed of light could enable travel in deep space, and perhaps enable the transmission of sending information back in time. It was only a few months ago that the case against the existence of any particles that could travel faster than light had been definitively proven. The formal announcement of this possible discovery will take place at the European Particle Physics Laboratory, Cern, in the near future.

On the way out to the Philadelphia area, I stopped at a Service Plaza on the turnpike. After parking the car and getting out, a brand new black Milan started pulling out just as what was once a Buick sometime back when Reagan or the first Bush was President was going by. This thing looked so pitiful, it wouldn't have qualified for Obama's "Cash for Clunkers" program. I started to shout to the Milan owner to stop, but too late. The sleek sedan banged into the left rear fender and bumper of the battered old wreck. With the smashing of metal, and the crunch of plastic came a rush of air as the Buick's left rear tire went flat. There was little question that the Milan driver was in the wrong as the wreck had the right-of-way. The Buick driver had the sense to know that his car wasn't worth much fuss, so he told the Milan driver to forget about the whole thing, even though it would mean a few hundred in his pocket.

I advised the driver of the wreck that he would have to put on his spare tire because the other tire was probably knocked off its "bead," the seal of the tire around the rim of the metal wheel, and would never hold air. The wreck driver contradicted me, claiming there was no such thing as a "seal around the tire." Besides, he had too much junk in the trunk of his "Buick" to get to the spare tire. He proceeded to limp the wreck over to the air pump.

"Look at that thing," I said to the Milan driver. "It looks like that guy thinks he has to hit something every time he drives off in that thing." It was a mass of dents and autobody putty; a "puttymobile."

The Milan driver mustered up a chuckle.

"Well, that's the way of things, isn't it?" I mused aloud. "When you're driving a nice car like yours, if you're going to hit something, it'll be a puttymobile like that one. I wonder how many times he gets pulled over driving a heap like that."

"And I have to make about another 400 miles tonight," the Milan driver said as he struggled to get his plastic bumper cover to stay in place. He had to make Richmond, Virginia that Sunday.

I spent a little time at the service plaza, and as I finally got up to a gas pump I saw the driver of the "Buick" at the air pump. He was emptying the trunk as he apparently now realized that there is such a thing as a seal around a tire and the wheel rim.

On the first day of train travel using the Clifton-Aldan station instead of Primos, I met an older man who is a fan of the Philadelphia Phillies. We talked a little baseball when I noticed one of the new SEPTA trains pull up to a platform. These trains have state-of-the-art cars with computer screens that show the next stop. The cars are clean and the seats brand new and comfortable as first class in an airliner. "I suppose we won't get one of the new trains," I said to the Philly fan. "We'll probably get another crappy one."

"Yeah, we always get a crappy one," he agreed.

It is probably not advisable to drive toward a hurricane or tropical storm, but I had to do it on Sunday, August 28th. There was a job assignment in downtown Philadelphia, and I had a hotel room waiting in a suburb within two miles of a SEPTA train station. It helps keep expenses down to stay just outside the city and commute by train as hotel and parking rates are high in the main sections of Philadelphia. On the Pennsylvania turnpike, I encountered a long column of tree trimming company trucks, equipped with "cherry pickers" to reach high tree limbs. Several had out-of-state plates and were coming to reinforce local tree trimmers to clear debris from Irene. The closer I got to the southeast corner of the state, the more piles of green leaves, blown against the center jersey barriers separating the east and west lanes of the turnpike, were visible. Rain was sporadic, starting after passing through the Blue Mountain tunnel. After exiting at Downingtown (actually Exton, Pennsylvania), I encountered the first evidence of loss of electrical power. Traffic lights were not operating along some parts of Route 100 going south. There were some more of these along Route 202. My objective was the Baltimore Pike, that would take me to my hotel by turning north on the pike. I made to to a turn toward Concordville when I saw that the Baltimore Pike was blocked. Stopping at a Wawa convenience store, I received the news from the cashier that Baltimore Pike was blocked by a tree.

Taking my coffee outside, and retrieving a detail map from the case in my car, I plotted an alternate route around the fallen tree. Street Road took me to Route 252, which goes east to Baltimore Pike after passing through Media, Pennsylvania. Route 252 is the way I used to travel to Philadelphia and the surrounding area when I used to live and work in the area from 1985 to early 1989. The Springton Resevoir is just below Newtown Square. I fished the reservoir many times back then, but no one can now since some cul-de-sac housing projects moved in along the shore. Finally making it to the hotel, I found that the power was out in that section of the town, including the hotel. The desk clerk said the power could be on "in two-to-forty-eight hours." I told her forty-eight was probably closer to the truth having lived through a power outage from Hurricane Ike in 2008 while looking in on my mother's property in Parker, Pennsylvania. The desk clerk canceled the Sunday part of my reservation, freeing me to go to another hotel. I retreated west about 25 miles to Phoenixville and camped in the French Creek Inn overnight, which isn't far from one of my residences from 1985-1989. Before leaving the first hotel, I drove through the back parking lot seeing that the tree trimmers were using it as a staging area.

The next morning, power was still out at my first hotel. When I got to the SEPTA train station at Primos, I saw that the daily parking lot was all torn up. A train traveler who had a monthly parking spot informed me that the Primos station was going to move the monthly permit parkers to where the daily parking used to be, and the daily parking would eventually move into the present monthly parking spaces. She told be to try the Clifton-Aldan station. Because of Irene, the R3 SEPTA line had additional commuters as some people from the West Chester area had to drive to Media or Elwyn and take the R3 instead of their usual train. A lot of us had to stand the whole way to Suburban Station in Philadelphia and then stand the whole way back. By Monday evening, the power was back on in my first hotel, and things became more or less normal for a trip to the Philly area.

I thought I was used to the high amounts on the gas pump screens, but this morning it cost me over $45.00 to fill the tank. I could feel my mouth gaping open with the shock of it all. This was unheard of even in the worst of the oil shocks of my younger years. I wondered if other people reacted the same way when the size of a fill-up really sunk in. This is what I probably looked like this morning.

As for the rest of the public, this is probably a pretty good cross section of what they looked like when the size of a trip to the pumps really drove itself into their brains.

|

|

|

|

|

|

I am working in an area where there is a lower-end Walmart-type store (sorry for the oxymoron) that includes a restaurant. Years ago some of my co-workers urged me to take a meal there as the prices were so low. Meals like "All You Can Eat Spaghetti" cost about $1.50. A big roast beef dinner was priced at $2.75. Want turkey helpings as big as Thanksgiving? Just pay $3.15. The extremely low prices made me wonder if there was a problem of some kind with the place. What follows is a paraphrase version of this ancient conversation.

There are more details coming out to the public domain about the Senate's audit of the Federal Reserve, which was the first audit of the institution in history. As pointed out in an earlier post, most of an avalanche of $16 TRILLON in "loans" made by the Fed went to foreign and domestic banks and corporations. There were some handsome sums handed out to some of the megabanks that helped pump up the real estate market into the biggest hot air bubble in the history of economics. You will be amazed at the size of the handouts these banks managed to get from the Fed. Here's a partial list:

Yes, they are loans, but so was TARP. A lot of the big banks that received TARP funds paid them back...by borrowing from the US Treasury. TARP was supposed to buy up all the toxic assets so these banks would keep lending to other banks that actually lend money to ordinary people. Well, we've learned the megabanks are keeping all their loanable funds locked up in the Federal Reserve as excess reserves. They aren't lending to any small businesses, but just hoarding cash at the Fed with one hand, and passing a tin cup with the other. That's some business plan. Something like Standard and Poors rating the mortgage backed securities these guys made AAA when they were nothing but JUNK, and then downgrading the United States after the mess S&P helped to create ruined the economy.

You can't make up stuff like this.

As students face massive debts to pay for college degrees that don't help them in the job market (at least this job market) a professor at Dundee University in Scotland has come up with an idea to "help" them, since bankruptcy is not an option with student loan debts. The students can sell a kidney, or some other organ of their bodies. Susan Rabbit Roff (I won't say "Wascally Wabbit") came up with this idea, saying for herself:

"I don't feel the need or the pressure for money. I'm a middle class person and I'm not in that situation, but we shouldn't legislate for other people."

In other words, laws against people auctioning off a lung on Ebay should be repealed so that graduates from colleges and universities can sell organs to pay off their student loan debts. We can't "legislate for other people," so why stop with organ sales? Since we can't "legislate for other people," why not repeal laws against prostitution, raising pit bulls as fighting dogs, and selling marijuana? If this is an indication of the kind of thinking that goes on with faculty membes at institutions of higher education, maybe the students should get their loans paid off by suing for nonperformance instead of listing their kidneys on Amazon as "stuff they want to sell."

A few months ago, we reported about the article by Matt Taibbi of Rolling Stone Magazine about the preliminary findings of the Congressional audit of the Federal Reserve. Taibbi described "Huge roaring rivers of cash" being doled out to the elites of Wall Street. Well, a lot of the money went off shore to corporations in South Korea and Scotland (?!). No offense to the Scots, but I don't understand why anyone there, or South Korea, Japan, or anywhere else, needed to get an amount of money that could have, in one swoop, solved any number of problems we are having now let alone eliminate the need for the big debate on a debt ceiling extension. We are talking about sixteen TRILLION dollars. A trillion here, a trillion there, and soon you are talking about real money. What follows are the first paragraphs of Senator Sanders' report, followed by a link to his Website with more details.

The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. "As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world," said Sanders. "This is a clear case of socialism for the rich and rugged, you're-on-your-own individualism for everyone else."

Among the investigation's key findings is that the Fed unilaterally provided trillions of dollars in financial assistance to foreign banks and corporations from South Korea to Scotland, according to the GAO report. "No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the president," Sanders said.

The non-partisan, investigative arm of Congress also determined that the Fed lacks a comprehensive system to deal with conflicts of interest, despite the serious potential for abuse. In fact, according to the report, the Fed provided conflict of interest waivers to employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans.

For example, the CEO of JP Morgan Chase served on the New York Fed's board of directors at the same time that his bank received more than $390 billion in financial assistance from the Fed. Moreover, JP Morgan Chase served as one of the clearing banks for the Fed's emergency lending programs.

I am at a seminar in Indianapolis, Indiana with Friday as my homecoming day. Yesterday, we ran behind schedule a bit, so lunch got cut short. I decided on something quick, so opted for a bowl of chili at about 12:15 PM. It tasted okay, but it wasn't very hot, more like lukewarm. I didn't think much about the serving temperature of the chili at the time, which was not wise. Ignoring the fact that I could still taste the chili nine hours later was probably a bigger mistake.

Something woke me up at about midnight. It was like an alarm went off in my subconscious: "Something is wrong. Wake up now!"

The "something"was the sensation of having something really big, and full of air--something like the Goodyear blimp or the Hindenburg--trapped in my intestines. "It's the (bleeping) chili," I thought to myself. "Why the (bleep) did you have to wake me up for this?" I cursed my subconscious mind. My second thought was to get some kind of over-the-counter medication down into my gut as rapidly as possible. I got out of bed an rummaged around in my duffel bag. I found some Zantac 75 pills which expired in December. I didn't care about the expiration. I would have taken the pill even if it meant being turned into a zombie from The Walking Dead. I was more afraid of exploding like some vampire killed by Sookie in True Blood.

The expired Zantac helped a bit by busting the huge air bubble in my gut into much smaller air bubbles. I just couldn't move around too much in bed as the air bubbles would rush around in the same direction, something like the trail of air bubbles that Lloyd Bridges would make in Sea Hunt.

By morning the chili was pretty well "cleared out" and I was able to keep morning coffee down. I've sworn off out-of-state chili for the time being. I've eaten worse chili with no ill effects, including the stuff from the old Hot Dog Shop in one Pennsylvania town. That stuff looked like something ladled from the bottom of a Buffalo wallow, but never did anything like this to me.

Living in America today is a lot like navigating your way through a looney bin. For three years there has been a media obsession with the murder trial of Casey Anthony for the charge of murdering her two-year-old daughter, Caylee. There was so much sensationalism built up over this that it became a national soap opera. After the OJ Simpson case, you would think that the last thing the legal system would want would be television cameras in a courtroom. It seems that everytime cameras get into the courtroom the public becomes completely insane when the accused gets acquitted, which always happens when a trial is on television following months or years of tabloid media hype that amounts to prosecuting the accused prior to the trial. Everyone morphs into Charles Bronson in the "Vigilante" Death Wish movie series. The woman who drove the younger woman off the road, after mistaking her for Casey Anthony, caused the victim's car to flip. The victim had to play dead to escape the situation. Note to the criminal justice system: There is no such thing as reality television. Once the cameras start recording reality goes out the window. If there had been no constant harping on cable television, followed by a televised trial, Casey Anthony would probably be getting ready to spend 25 years to life in prison. That is the way it usually works when television doesn't get in the way, causing some jurors to think that fame and fortune is just one fruitcake verdict away. The smart jurors in this case submitted to interviews only if the cable network hid their faces from the camera. After all, they didn't want to open their front door to get the morning paper and get a 9 millimeter greeting from a Charles Bronson wannabe, or have that female stunt driver run them down on their front porch.

I confess to watching some of the post-trial coverage, especially the video of Casey Anthony talking to visitors at the jail. I have to tell you that watching those conversations made me recall the comedy series Hogan's Heroes. Hogan's Heroes was a comedy set in a Nazi prisoner-of-war camp, Stalag 13. The Allied prisoners in the camp were constantly outsmarting the German commandant of the camp, Colonel Klink. One trick they liked to pull was "playing" to all the "hidden microphones" Klink had in the camp barracks. The POWs would make up a bunch of lies and conduct scripted conversations so Klink would hear them. During one such stunt, POWs actually sang Roll Out the Barrel in the background complete with a conductor. I half expected something like that whenever Casey Anthony would be sitting behind the glass conversing with her parents, telling them how much she loved them, especially dear old Dad ("Roll out the barrel...We'll have a barrel of fun...") and how sure she was that Caylee would be found alive ("It's time to roll the barrel while the gang's all here"). I really think Casey, and maybe even her parents, played to the cameras during those visits. Dad Anthony, after all, was a cop in Florida. He would know all of the conversations at the jail are recorded.

Sometimes I can't help thinking Ashton Kutcher is going appear on camera and tell us we've all been "Punk'd" for the past three years. That would mean there never was a little girl killed, somehow, by someone. Unfortunately, that was the only real part of this entire mess.

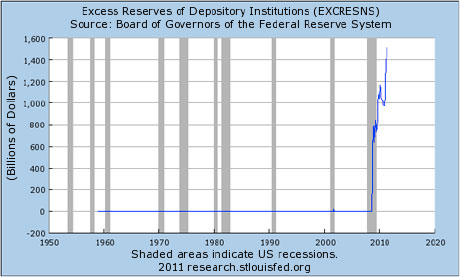

Ellen Brown, reporting for the news and opinion site TRUTHOUT, reported on July 15th (Why Banks Aren't Lending: The Silent Liquidity Squeeze) that the main reason why job creation is lagging is the Federal Reserve's policy, initiated just before the panic of 2008, of paying interest to the banks for the reserves the banks are required to keep with the Federal Reserve. Banks are required to keep a certain level of cash with the Fed that is called "reserves." The purpose of the reserves is to maintain a desired level of liquidity by "locking it up" with the Fed. The remainder of the banks' cash was used to fund daily operations and to lend money to each other and to the public. By paying interest on the reserves, the Fed is encouraging the banks to just lock up the cash with the Fed. The money does not go out in loans, particularly loans from the big megabanks to smaller regional banks.

Small businesses and start-up businesses have trouble operating without a supply of credit. The smaller, local banks can't borrow short-term from the megabanks today as the big boys are content to leave their money with the Fed in the form of "excess" reserves. The Fed pays .25% for the excess reserves, which is what the megabanks would get for far riskier loans to other, smaller banks. This is especially true with the banks paying so little for deposits of all kinds. Some small businesses are forced to rely on credit cards that run 16% or better at an annual rate. This just props up large bank profits even more. The megabanks have reduced small business lending by 50% since the 2008 disaster, and control over 50% of the excess reserves with the Fed.

One justification for TARP and the other bailouts of the banks was to keep the banks lending so the recession would be brief and high levels of unemployment could be avoided. With the Fed paying .25% for excess reserves, all the government's bailouts failed to reduce the effects of the recession. The Fed started paying interest on reserves in July 2008, so the banks stopped lending because of the interest paid on excess reserves. The timing of all of this is fascinating as is a Justice Department policy about prosecuting "Commercial Crimes" that came out in late August 2008, about three weeks before the torpedoing of Lehman Brothers, and the resulting fallout on AIG, touched off the panic. The new prosecutorial policy made it tougher to prosecute white collar crime just before the biggest white collar crimes in the history of the universe exploded all over the economy. It was all probably an accident of some kind. We all know none of this stuff is ever planned. Guys with MBAs and Juris Doctor degrees just suddenly become, well, incompetent, that's all. Those who benefit (big time) from the sudden brain farts of the government experts are just lucky...and Lewis Black was wrong. The Flintstones was a documentary about prehistoric times.

I'm sorry, but some Russian sitting at an aging, beige 386 computer somewhere in the Urals, who just tried to break into your computer after finally getting on the Internet with dial-up while a babushka woman worked the switchboard plugs, isn't the only crook in the world! I know this is a drag and a downer, but someone has to say it. The probability that a series of fortuitous, random events could be so perfectly aligned, right down to making it tougher for crooks to be prosecuted, right before the caper goes down, is a little tough to swallow. It is sort of like believing the fix isn't in when a juiced up Barry Bonds loses a Little League home run derby.

In 1937, the Fed doubled the reserve requirements, and this extended the Great Depression into 1941. Ellen Brown cites economist Jeff Hummel of San Jose State University as warning that paying interst on the reserves is having the same effect as doubling the reserve requirement. Both Fed policies locked up liquidity that could not go out in loans to stimulate the economy. Bush and Obama could throw around stimulus money until the deficit caused a growing public fear of national bankruptcy while having no effect on unemployment because small businesses, that do most of the hiring, could not get any funding to take advantage of opportunities that arose from any stimulus policies. A lot of the stimulus dollars wound up with large corporations that do little hiring. While elected politicians push stimulus, the Fed has been putting the economy on a tranquilizer.

Once during my earlier years in this workplace I was involved in mostly standard audits with crews of various sizes. One job took me to Pittsburgh as part of the three-person crew in the middle of a hot summer in Pittsburgh, and one of my team members had a surprise for the one female in the group. He brought a cage of two small gerbils for the woman to give to her daughter. Now, the woman didn't like the idea of placing the gerbil cage outside in the back of her pick-up truck, so my other co-worker put the cage containing the tiny creatures back into his car.

"Uh, are you sure you want to put those gerbils in there?" I asked with hesitation. I hesitated because no one ever listens to me when I warn them about something. "It will be very hot this afternoon, with no clouds when the sun gets high."

"Gerbils live in the desert. They will be all right," my co-worker assured me.

"Okay," I replied, washing my hands like Pilate, while thinking that the desert is one thing, as the gerbils could always skitter into some hole under a rock when the sun gets brutal. That car would be more like a microwave oven than a desert once the sun really got high.

I knew right then that the gerbils were doomed.

After lunch, I walked ahead of the others and made straight for my co-worker's car to check on the hapless gerbils. I couldn't see them in the cage, but spotted two lumps under the torn strips of newspaper at the bottom of the cage. The gerbils had tried to burrow under the newspaper as the temperature in the car rose higher. It didn't work. There was no sign of the gerbils breathing under the newspaper pieces.

When my co-workers caught up, I made the announcement. "I hate to be a killjoy, but I checked and the gerbils are not moving."

The co-workers rushed to the car. The man took the cage from the backseat and jiggled it saying, "Aw, they are just sleeping." The more he jiggled the cage, and watched the tiny corpses roll around, he finally had to concede that the little rodents were deader than a bag of nails.

Now, the sight of the dead gerbils rolling in the cage made me involuntarily recall a toy I used to play with as a boy. There was a game board, something like a pin ball machine board, inside a clear plastic box. There were holes in the pinball machine board and the object was to keep moving the small game box around until all of these little b-b's rolled into the holes. The dead gerbils rolling in the cage reminded me of that game. Out of respect for the deceased, I kept this to myself.

My co-workers were devastated. "Do you think they suffered very long?" the woman asked out loud, but to no one in particular.

"I don't know," I replied, "as I have never had cause to boil the brain of a gerbil to measure the process."

They still don't listen to me.

Just when I think the squandering of citizens' money by our officials--er, public servants--couldn't get any more loony or outrageous here comes a story that someone finally decides to publish, but only too little, and way too late. Apparently, our "leaders" are so skilled at throwing money around that they found out precisely how many $100 bills could be shrink wrapped into a giant brick and stuffed into a C-130 transport plane and flown to Iraq to pay for the reconstruction of the country that:

Oh, I almost forgot, the total of $100 bills in the giant brick just happened to be $2.4 BILLION. The Pentagon made enough flights like this to comprise $12.0 BILLION. There's one problem. They can't find $6.6 BILLION. Now, I realize this is chump change compared to the bailout of the "Bubble Boys," which amounted to TRILLIONS, but how in the hell could anyone misplace three big bricks of $100 bills? You would need a forklift to make off with all of it. It would be certain to make a bulge in someone's clothes ("Is that 6.6 billion dollars, or are you just glad to see me?") and even Kyra Sedgwick's purse on The Closer couldn't contain all of it. It's gone, and the Pentagon auditors suspect theft, but it is a good bet nothing will ever happen to whoever stole all of it. On the other hand I feel safer because we can sure give those on-line poker players hell.

We have two stories about the megabankers, "The Bubble Boys." In the first story, the public wins a victory, albeit a small one. In the second story, the banksters win. When you split a doubleheader it is like kissing your sister, but the first story will be very satisfying to most readers.

The second programme for Greece, which will effectively supersede the 110 billion euro ($160 billion) bailout agreed in May 2010, will involve some participation of private sector investors but limited to avoid triggering a credit event, the source said. (SNIP)

Translated, this means it is NOT Greece that is getting bailed out. It will be the behemoth uber-banks that will be getting the bail out. In other words, it is another "bail-out" pay day for....The "Bubble Boys!"

I keep hearing that there are some people out there who don't like it when someone is skeptical about a government and "mainstream media" explanation about some avoidable disaster that befalls us. Typically the explanation of the government and media are exactly the same, but some would argue, irrationally, that this is just a "coincidence." Yes, I know that this argument was briefly criticized in another posting here. I just thought it would be a good idea to expand on this thought briefly. To say that something like the government and big media always telling the same story about some terrible event is "just a coincidence" is actually a meaningless redundancy. Sure, this is a "coincidence," or a co-incidental event. The stories of the government and media about, say, Libya, are typically in synch. Since these stories are identical, and told at the same time, about the same event, they are a "coincidence," or more precisely, co-incidental. Just saying this proves nothing about whether or not the story about Libya is true, or complete, or just a pack of lies. Calling them "just a coincidence" begs the question as some people want to know why they are coincidental. You cannot explain why two things are occurring co-incidentally by repeating that they are co-incidental. It would sound something like this:

See how an argument that is usually presented as an all-wise, sophisticated, invincible trump card can be made to look ridiculous? Fun, isn't it? Anyway, this stuff about "coincidence" thinking (if you can call it thinking) is a digression. I will spend more time on this later, but, you see, if it becomes illegal to not believe something the government and media tell us I will be in more trouble than most. Actually, I no longer believe one damn thing either the media or government claim wihout checking them out. When it is impossible to gather enough evidence to make a determination, I just don't make a judgment. If not believing the government and media becomes a crime, I just might wind up in the deepest dungeon of a Super Max somewhere. If such a law gets enacted, what is a perennial skeptic like me to do to avoid incarceration?

Wait! I know what to do. It will be a lot better disappearing in some hole waiting for some archaeologist to come along and dig up my mummified corpse in about 1,000 years. If I am asked if I believe the latest government and media version of some man-made catastrophe I will do exactly what politicians do. I'll lie.

"Of course, I believe every word our government tells us as reported by the big media outlets. So, you have nothing to worry about when it comes to my opinions. Oh, try some of these jellybeans, Inspector. They are very fresh. The Easter Bunny gave them to me."

The financial blog for investors and entrepreneurs, The Wall Street Cheat Sheet, in an article from March 2011 explained how all of the federal bailouts are doomed to failure despite the tens of trillions poured into the behemoth financial institutions, political favorites, and special interests. Here are a few paragraphs to get things started, then go to the link below for the entire article. People can't know too much about the long-term effects of the massive financial chicanery which just happened to be timed to the biggest challenge to pension funds, Social Security, and Medicare, the pending massive retirements of the "Baby Boom" generation. I could say that this is all a coincidence, but that doesn't tell us a thing. Just saying two events are "co-incidental" neither proves, nor refutes, any direct causal relationship between two events. It merely describes that they are co-incidents in time, but we all know that already. Being in a co-incidental state is part of the natures of the events, therefore we are not proving, nor disproving, anything about them by using the word "coincidence." It is like a circular argument to try to prove anything by just saying two incidents happening in order, in the same general time frame, and/or that share actors are a "coincidence." It would be more logical to argue, "It is an accident that the bank disaster and the retirements of the Boomers are coinciding like they are." That the co-incidental timing, shared actors, or shared results of the events is an accident would still, however, require some kind of evidence to support the argument, just like a claim that the one was deliberately done because of the other would require evidence. This whole matter of "coincidence" will have to be addressed in an article about logic and metaphysics in the future. The Wall Street Cheat Sheet article is especially timely, despite being almost three months old, with CNBC describing the economy as being in "free fall" after months of declaring the recession over, something like "Mission Accomplished." This thing is far from over.

Back to our sad reality, thanks to the politically correct and economically cruel belief within both major parties that home ownership is a “good” that must be promoted by Leviathan, our allegedly limited federal government is very much entangled in the housing and lending sectors, and we taxpayers inevitably suffer those distortions wrought by our government nannies. All of which returns us to the banks and the unfortunate bailouts of 2008.

With major lenders already subsidized by federal housing programs created to foster greater ease among banks to make non-economic loans, once those institutions failed at least partly due to the imposition of the aforementioned programs, Washington couldn’t then let the banks die. Not only might this lead to a reduction in the way of home loans, but thanks to government support of the banking industry such that they grew large enough to be systemically material, the government had to protect what its policies created.

The long-term result is that far from saving the banks (NYSE:XLF), the federal government merely delayed their descent into irrelevancy; the U.S. economy the long-term victim under such a scenario.

To understand why, it has to be remembered that once a business of any kind takes government aid, it’s no longer in the business of profit. Instead, it serves a new, non-shareholder constituent in the form of political masters who don’t care about profits. Politicians see businesses as social institutions meant to promote all manner of activities that sound compassionate, but that only bring distress to businesses, investors, employees and customers.

A more recent OP-ED piece in today's Pittsburgh Tribune Review titled The Reappearing Recession by John Browne presents this status report on the banking industry, particulary those behemoths controlled by "The Bubble Boys" of Wall Street. Frankly, the following paragraph from the article is enough to frost anyone who has been paying attention. The "too big to fail" problem is now worse than it was in 2008:

As a result of the Fed's actions, over the past three years, the banks are no longer merely "too big to fail," they are now even bigger, or "far too big to fail." Apparently, the Fed has magnified -- not reduced -- the adverse risks of bank failure. (Read more: The reappearing recession - Pittsburgh Tribune-Review http://www.pittsburghlive.com/x/pittsburghtrib/opinion/s_740353.html#ixzz1OSGPmAR2).

The bail-outs have failed, at least for the general public. They have worked out just great for anyone who was on the receiving end, of course, but someone--somewhere--is bound to say that it is all a "coincidence.".

|

|

Work hasn't taken me to York, Pennsylvania very much since spending about three weeks there after Thanksgiving in 1993. Spending another three weeks there this spring wasn't anything too special until early the first morning in the parking lot of the Holiday Inn I heard a particularly loud, but melodious bird's song. Following the sound, it turned out to be a Gray Catbird, my favorite North American bird. It was perched on a handicapped parking sign, imitating what sounded like snatches of a robin's song, some golden finch, and some other warbles and whistles, with a few grackle calls mixed in. By the looks of the white and black stains on some of those handicap parking signs, the catbird appeared to use the signs a lot for singing perches, so I went back at dusk to see if the bird showed up. It did, singing similar songs as the one it performed that morning. Trying again at dawn twilight, the catbird was back again. The bird was in good voice the second morning, as I could hear the song from the second floor of the hotel as I walked down the hallway. Each time I listened, I would stand a little closer. Sometimes the catbird would move to another sign, but keep up the singing. On Wednesday, more guests showed up at the hotel for a Hot Rod show that takes place every year. With more strange humans around, the catbird moved the daily concerts to a tree branch. It took some time to find the bird, but once it was located, it looked down at me while it sang its song that morning. This Friday morning, my last day at the Holiday Inn, the catbird was singing from the thick tangle of trees and brush at the edge of the full parking lot while I loaded up the car to leave. I tried to see the bird up in the tree, but gave up as the light was so dim, but as I headed for the door, the catbird landed on one of the handicapped parking signs and started singing again. I was only a few feet away from the bird, at the door to Entrance B, while listening for a few minutes. After awhile, I applauded quietly, sent the catbird a few whistles, and opened the door. The catbird flew off just as the door opened.

Also this week, I had my first encounter with a truly talented Northern Mockingbird. This was on Thursday when the bird perched on a telephone wire across the driveway up to the Ruby Tuesday restaurant on Saint Charles Way. At first, I thought I had heard a Killdeer, but the call came from above me which was unusual for a killdeer. The call was dead on. It was a mockingbird, imitating a killdeer, and about a half-dozen other birds mixing in songs and calls, including robins, finches, chickadees, the calls of blue jays, crows, and just for good measure throwing in such sounds as a ringing cell phone and what sounded like a car alarm. The mockingbird would sometimes fly up from the wire in a "U" pattern, singing through the entire motion, and landing back on the wire, a song and dance bird. The mocking bird could be heard clearly all over the neighborhood. It might have been the strongest singer of any bird I've heard, with its closest rival the catbird at the Holiday Inn. It was an entertaining show, but most of the other adults, busy with Personal Digital Assistants, missed it, but some of the kids going by would look up, enthralled at the feathered show-off.